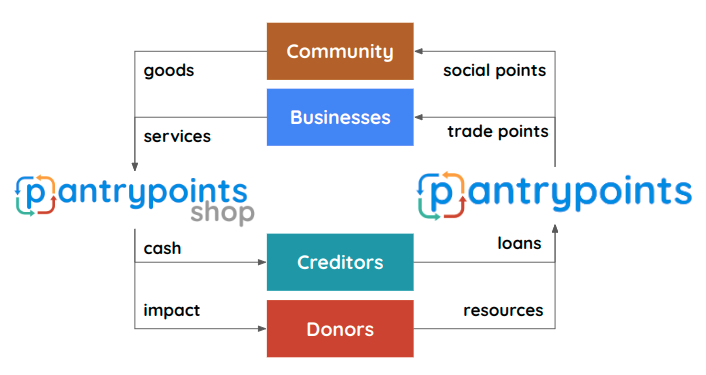

What is Pantrypoints?

A points-based economic system, as stored-value barter, designed to solve the problems with the money system such as inflation, poverty, inequality, unemployment, stagnation, financial crises, debt crises, trade wars, etc.

(Press spacebar or click on the arrow on the lower right to continue. Press Esc to browse the slides)

What are the Problems with the Money system?

Money can be hoarded. This stops the economy from circulating

You need to guard the money – this raises the cost and creates the risk of theft, armed robbery, phishing, scams, etc.

You need to wait for the money payments. Delays can halt production

People chase money instead of chasing skills and productivity. This leads to people talking instead of doing.

The Problems with Money Naturally Lead to Crises

Paper money and stock certificates were invented in the 17th century in Britain and France, by learning from the Italians and Jews.This gave Europe the capital to launch colonization via Royal Companies.

Afterwards, credit crises and large wars became frequent.

- 1772 Credit Crunch and 1779 American Revolution

- 19th century Napoleonic Wars

- 1915-1945 World War I and II

- 1954-1991 Cold War

- 2008 Financial Crisis

- 2020 Stagflation and Ukraine War

Crises Can be Predicted

The Pattern of Money and Crises helped us create a model that predicted a global stagflation starting from 2019, eventually leading to war.Governments will not be able to solve it because all governments are money-minded (mukhang pera). For example, the solution of the Philippine government to the Covid recession was to incur trillions of new debt.

The ancient solution was stored-value barter

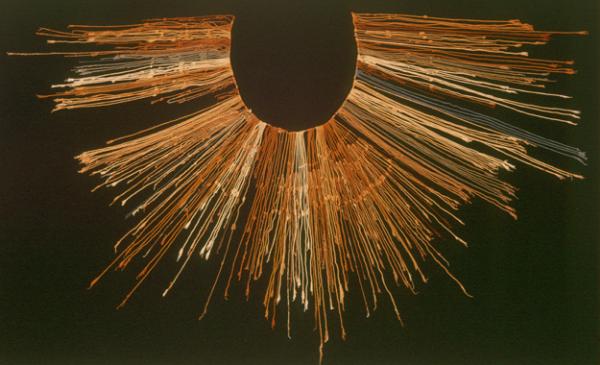

The Inca government avoided crises by using strings, as knots, to record the value of the work done by the citizens. It would pay the people with food from the granary. This system created economic order and reduced war. Instead of knots, we use points. Instead of granaries, we use pantries, thus leading to Pantrypoints.

Precolonial Philippines (as Ma-i or Maharlika Used Delayed-Barter

Historian Chau Ju Kua writes:“The Maharlikan traders assemble in crowds and carry the goods away with them in baskets. Even if the foreign merchants do not know the Maharlikan traders, there will be no loss.

The native traders will bring those goods to other islands for barter. It will take 8-9 months for them to return. They then repay the foreign merchants with what they had obtained for the goods.

Some, however, do not return within the proper time. This delay is why vessels trading with Maharlika are the last to return home.”

What is Stored-Value Barter?

Stored-Value Barter uses records to prove the claims of traders. Immediate barter does not record or 'store' values.

- The Inca used knots on strings

- Maharlika used leaf-notes and copperplates

- Pantrypoints uses databases (‘Web2’ for national commerce) and will use private blockchain (‘Web3’ for international commerce)

Stored-Value Barter is a Debt System in Kind

An example of stored-value barter is the family economy.The parents spend for their children who are expected to bring home good grades in return, and be productive in the future.

Parents never ‘monetize’ their children. Instead, they ask their children to do chores in exchange. Friends and family never objectify value. Instead, they let value flow naturally for mutual benefit.

Stored-Value Barter Nourishes EQ and Delays Gratification

Emotional Quotient (EQ) is seen in the Marshmallow test where children chose to get their rewards later. Such children became successful in life.

How it Works for Goods (Offline Mode)

- Local Government provides seeds and fertilizer to urban farmer

- They write the valuation in “point-cards”

- Urban farmer gives part of the harvest to the Local Government according to the point-cards

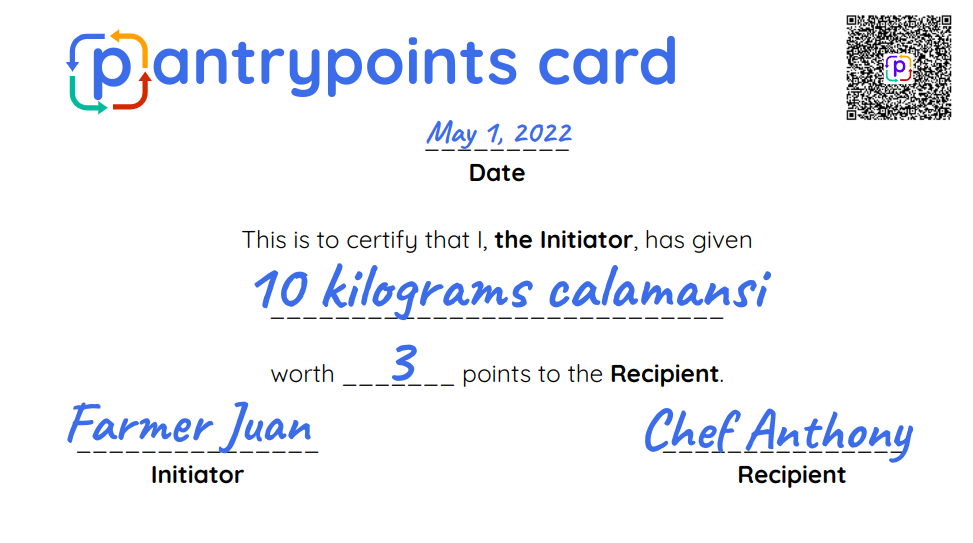

Points Cards

These are bilateral 'blank checks' between 2 parties in a trade. The truth of the value in these cards are verified by Points-banking.

How it Works for Services (Online Mode)

- A web developer makes a website for a small restaurant

- The restaurant pays the web developer in meals to the value of the website, measured in points, through the Pantrypoints app

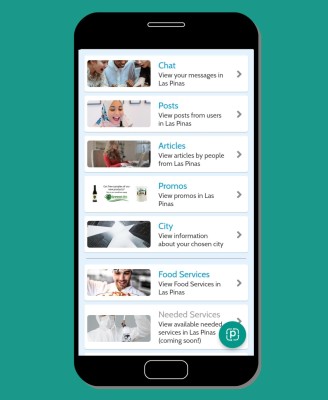

The Pantrypoints App

The App does the work of Points cards and lets users transact points with each other. It also makes points-banking easier.

Pantrypoints will Power the Digital Transformation of Micro-Small Businesses

Software developers are expensive because they have to go through a 4-year course.

We will train our own software developers from high school level using the Bootcamp model

This will make websites, apps, IoT, blockchain, and data science cheap so that more Micro-Small Businesses can use them.

Points Mechanism:

1 Point = 38 pesos (as of January 2023)

The 38 pesos represents the retail price of basic rice (NFA), which is linear and predictable.

- 2003 - 21 pesos

- 2010 - 27 pesos

- 2018 - 32 pesos

- 2020 - 35 pesos

- 2022 - 38 pesos

This will create stability in the economy, different from the fiat system which is based on nothing.

Expansion to World Trade

The points system expands to world trade via Pool Clearing, where national rice price is the basis of currency.

For example, the “pool exchange rates” between Vietnam and the Philippines is below

| Year | Current System | Pantrypoints Pool System |

|---|---|---|

| 2010 | 1 USD = 40 PHP = 19,000 VND | 1 USD = 27 PHP = 8,000 VND |

| 2022 | 1 USD = 58 PHP = 24,000 VND | 1 USD = 38 PHP = 12,000 VND |

| Difference | 18 Pesos, 5000 VND | 11 Pesos, 4000 VND |

Revenue Model: Points Taxation

The system will earn by points taxation in kind which will then be sold for cash in the Pantrypoints shop.

Example

A farmer grows 10 kilos of tomatoes per harvest by using our system. At 5% points-tax, he should give us 500 grams or 5 large tomatoes.We will then sell it for cash to remit to government (as modern ’tax farmers’) and to our creditors.

Points-Banking

Points are bilateral. To diversity one's revenue, a user might want to transfer his points balance to a third person. This transfer must be approved by a bank to make sure that it is backed by real productivity. The bank then earns a few points for facilitating the transfer.This will be a new business of banks.

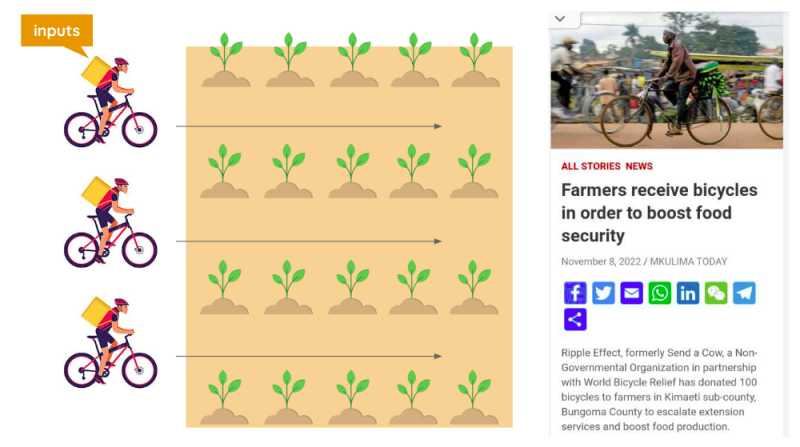

Implementation: Village Contract Farming

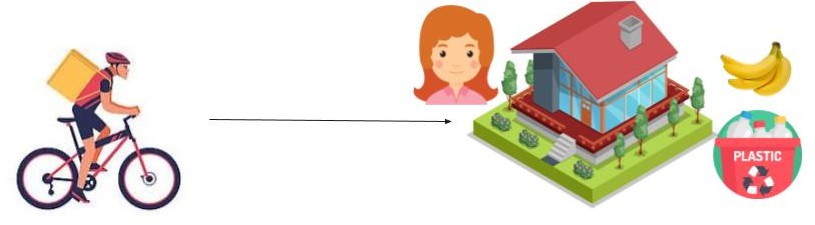

We create a circular economy based on bicycles and manual labor in order to mitigate the effects of high oil and energy prices.

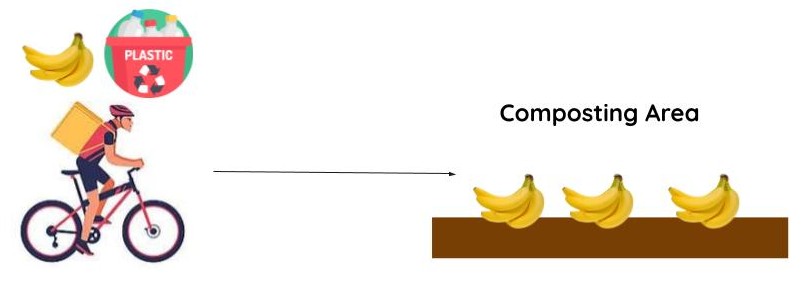

Step 1: We collect plastic waste and kitchen waste from participating homeowners

Step 2: We bring plastic waste to recyclers, and kitchen waste to composters to become fertilizers.

Step 3: We use the fertilizers to grow crops in rent-free urban plots with community labor.

Step 4: We give most of the harvest to the community. The excess we sell for cash to pay interest to the lender.

Step 5: We use the small cash flow to get a bigger loan to implement the system in larger farms outside of the city to eventually sell for export.

Results: 23% Success Rate

We seeded 6 plots in various areas with volunteer growers. Only 3 plots produced crops leading to a 23% success rate (105 sqm out of 465 sqm). The larger the plot, the greater the chance of failure. Thus, our focus is to increase the number of plots.

Funding Needs: Php 100,000 Peso grant

To increase the success rate, we plan to give rice as incentive to the volunteer growers, as consumables of 1 kilo per hour of laborFeb 2023-Jan 2024

| Item | Cost |

|---|---|

| 1 Second hand Motorbike for transport | 45,000 |

| Consumables for 2 plots for 1 year | 30,000 |

| Petty Cash for prizes, Insurance, Government fees (paperwork, notarization, etc) | 11,000 |

| 2 Android Phones | 10,000 |

| 2 Second-hand Bicycles with rack | 4,000 |

Projected Timeline Year 1

| Month | Goal |

|---|---|

| Feb 2023 | Register company as Barangay Micro Business and make websites and apps for micro and small businesses to earn cash and grow network (such as SuperPaso) |

| Feb-March 2023 | Finalize agreements with LGUs and donors on plots for planting |

| April 2023 | Finalize agreements with barangays or NGOs for labor. Start sowing seeds |

| May 2023 | Transplant seedlings |

| July 2023 | Measure harvest and start sowing batch 2 |

| Aug 2023 | Transplant batch 2 |

| Oct 2023 | Measure harvest and start sowing batch 3 |

| Nov 2023 | Transplant batch 3 |

| Jan 2024 | Measure harvest |

Investment Plan: Grant-to-Loan-to-Equity

We advocate a grant-to-loan-to-equity model. Stakeholders give a small grant of $100 to $2,000 to start a community plot for their own benefit on year 1. If successful, subsequent years will be funded by loans. After 5-10 years, unpaid loans will be converted to equity| Year | Needs |

|---|---|

| 2023 | Grant: Php 100,000 (Register as sole prop) |

| 2024 | Loan: Php 30,000 |

| 2025 | Loan: Php 100,000 |

| 2026 | Loan: Php 300,000 |

| 2027 | Loan: Php 500,000 (Test in large farms) |

| 2028 | Loan: Php 1m |

| 2029 | Loan: Php 3m (Conversion to corporation) |

| 2030 | Loan: Php 10m |

| 2031 | Loan: Php 30m |

| 2032 | Loan: Usd 1m (Expand overseas) |

Potential Partners

A few notable companies have expressed interest in using the Pantrypoints system as partners

History

| Year | Details |

|---|---|

| 2009 | Juan applies for MEXT scholarship to Japan to research solutions to the Financial Crisis but is not accepted |

| 2010 | Juan moves to Vietnam to work in web development while doing personal research, looking into Vietnamese agricultural policies |

| 2015 | Juan applies for MEXT research scholarship to publish his research but fails to get scholarship |

| 2017 | Juan registers a tech startup, SORA (SOcial Resource Allocation), to implement his solution as a points-based economic system in preparation for a 2019 stagflation |

| 2018 | Juan fails to get investors so Juan closes SORA and returns Manila to continue the research |

| 2020 | Covid creates the predicted stagflation. Juan changes SORA into “Pantrypoints” inspired by community pantries |

| 2022 | Small businesses join the Pantrypoints system |

For more information

| Founder | Juan Dalisay Jr. |

|---|---|

| Website | pantrypoints.com |

| Mobile | 09605 424 101 |

| jundalisay@gmail.com |